Over the years, I’ve observed that many business owners we have worked with are not fully prepared for a premium exit (i.e they leave money on the table) when they exit their business:

- They don’t fully understand and work on the value drivers in their business;

- There is a not full appreciation for what “premium” buyers expect in terms of due diligence; and

- There is not often a plan to run and leverage a formalized sale process.

In a recent discussion with Nick Bradley on his podcast “Scale Up with Nick Bradley”, I touched on a number of these topics and referenced several checklists that I often refer to when advising and guiding our clients.

Expectedly, discussing the full subject of attempting to maximize a company’s final sale price and all of the processes that go along with that cannot be accomplished in one podcast episode.

I have expanded on the topics of our latest podcast episode in this article to provide an expanded view of how business owners can better prepare themselves and their company for sale/exit.

Understanding Value Drivers

Value drivers (and detractors) can vary greatly from one business and industry sector to the next. Having a clear understanding of these factors and managing them based on metrics and data can increase value significantly. Few business owners invest the time to truly investigate and manage value drivers in their business.

Key areas to identify value drivers include:

Industry and market cycle

Take advantage of key trends in your sector. We’ve had multiple conversations with private equity firms where there is a common sentiment that many business owners sell when they are ready, rather than evaluating industry and market timing in an effort to optimize value.

Management team

In most cases, buyers want to acquire a company that can continue to operate under new ownership and it’s hard to do this without a full management team already in place. As such, having a team that can create a seamless transfer or ownership and allow the buyer to leverage the asset they acquired can be a strong value driver.

Intellectual property

Businesses with a well thought out IP strategy and protected IP are worth more than businesses that have not invested in and protected their IP. In most businesses, even those engaged in services, significant untapped potential exists.

Desired business metrics (for your industry)

As I mentioned in the discussion with Nick, I have yet to see a private company have a dashboard of value drivers that are discussed and managed on a regular basis. Doing the work to understand and enhance value drivers can create significant value. This is what many buyers work on after they acquire businesses. These metrics are often items beyond just revenue and EBITDA and can vary greatly by industry sector.

Predictability of business

Finding ways to build in repeatability and predictability drives value. Predictable revenue and profits drive value. Many businesses do not take the time to do formal budgeting driven by operating metrics. If you don’t have this, you don’t have predictability.

Clear differentiation from competition

Businesses that focus on and understand their unique value proposition and barriers to competition are worth more than businesses that don’t. Many business owners can describe what they do, but don’t have a clearly articulated strategy in this respect that the business follows.

Preparing for Due Diligence

Almost all of our clients are surprised by the level of detail buyers will go into during their due diligence phase. As a rule of thumb, sellers should expect that a buyer needs to understand the business as well as the seller does in order to be convinced to pay a premium value.

There are often 10+ different streams of due diligence that take place. Prior preparation can streamline this process and eliminate value detractors. Common streams of due diligence that buyers perform include:

- Business and Financial Projections

- Industry and market research

- Accounting (Q of E)

- Legal

- Tax (Sales Tax, Income Tax, etc.)

- Employment Practices / Human Resources / Culture

- Insurance

- Information Technology and Data Security

- Intellectual Property

- Regulatory (industry specific and state/federal regulations)

A Formal Sale Process

While we did not discuss this at length in our latest episode, running a well thought out and formalized sale process can create significant value. Investment bankers look through the lens of the buyer to prioritize value drivers, mitigate risks/value detractors, and position the business in an effort to maximize the final sale price.

We have seen that we are often able to find buyers that are not known to the seller as well as create competitive pressure to enhance value, well beyond and fees and expenses that are charged. Interested in learning more? Reach out to our team today.

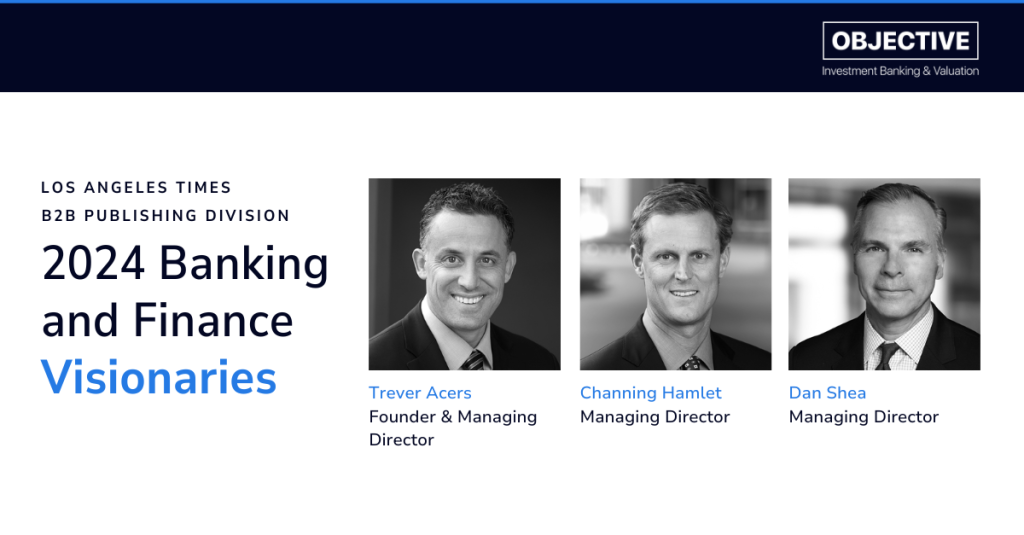

About the Author

Managing Director

(310) 570‑2721

Disclosure

This news release is for informational purposes only and does not constitute an offer, invitation or recommendation to buy, sell, subscribe for or issue any securities. While the information provided herein is believed to be accurate and reliable, Objective Capital Partners and BA Securities, LLC make no representations or warranties, expressed or implied, as to the accuracy or completeness of such information. All information contained herein is preliminary, limited and subject to completion, correction or amendment. It should not be construed as investment, legal, or tax advice and may not be reproduced or distributed to any person. Securities and investment banking services are offered through BA Securities, LLC Member FINRA, SIPC. Principals of Objective Capital are Registered Representatives of BA Securities. Objective Capital Partners and BA Securities are separate and unaffiliated entities.